As the digital world continues to expand, so do its environmental impacts. Artificial intelligence (AI) and cryptocurrency are not only revolutionizing industries but are also becoming significant contributors to global carbon emissions. The massive energy demands of these technologies are leading to growing concerns about their environmental footprint, sparking debates about the role of tax policies in curbing their emissions.

The Power Hungry Giants

Both AI and cryptocurrency are notorious for their substantial power requirements. Cryptocurrency, particularly Bitcoin, relies on energy-intensive processes to “mine” new coins. To put it in perspective, a single Bitcoin transaction consumes as much electricity as the average person in Ghana or Pakistan uses over three years. Similarly, AI tools like ChatGPT, which require extensive data processing, use approximately ten times more electricity than a standard Google search.

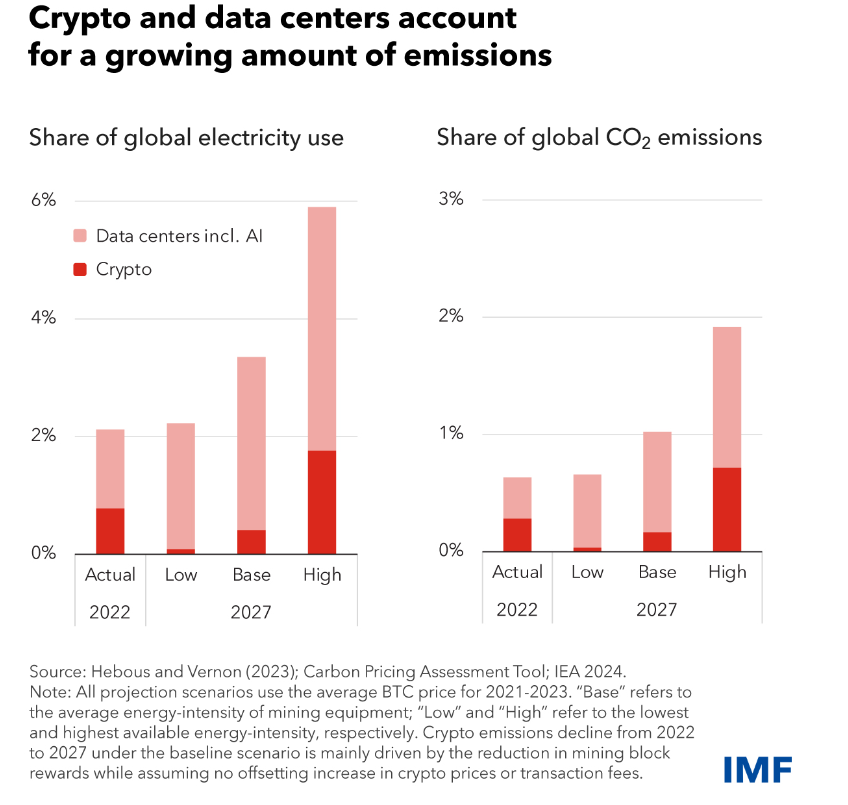

According to IMF blog, cryptocurrency mining and data centers collectively accounted for 2% of the world’s electricity consumption in 2022. This figure is expected to rise to 3.5% by 2027, equaling Japan’s current electricity usage, which ranks fifth globally. The environmental toll of these activities is alarming, with projections indicating that crypto mining alone could contribute to 0.7% of global carbon dioxide emissions by 2027.

Taxation as a Tool for Change

Given the significant environmental impact, there is growing discussion about how tax policies could be used to incentivize reductions in carbon emissions from these sectors. A recent analysis by the International Monetary Fund (IMF) suggests that a direct tax on electricity use could be a powerful tool. For the cryptocurrency mining industry, a tax of $0.047 per kilowatt-hour could push miners to adopt more energy-efficient practices, aligning with global emission reduction goals. If air pollution’s health impacts are also considered, this tax could increase to $0.089 per kilowatt-hour, potentially raising $5.2 billion in global revenue and cutting emissions by 100 million tons annually—equivalent to Belgium’s current emissions.

For data centers, which typically operate in regions with greener energy sources, a slightly lower tax of $0.032 per kilowatt-hour could be effective. Including air pollution costs could raise this to $0.052 per kilowatt-hour, potentially generating $18 billion annually.

Rethinking Incentives

Ironically, many data centers and crypto mining operations currently benefit from tax exemptions and incentives on income, consumption, and property. However, given their limited employment benefits, strain on the electrical grid, and environmental impact, these special tax regimes may do more harm than good.

On a positive note, AI applications have the potential to optimize power usage, possibly offsetting some of the energy demand. With the right policies, governments can encourage the development of AI tools that promote energy efficiency while mitigating their environmental damage.

A Call for Coordinated Action

While a globally coordinated carbon price would be the most effective measure to reduce emissions—encouraging cleaner energy sources and better energy efficiency—such an initiative remains elusive. In its absence, targeted tax measures could push the crypto and AI sectors toward greener practices. Complementing these taxes with incentives for using renewable energy, such as credits for zero-emission power or renewable energy certificates, could further enhance their effectiveness.

Cross-border collaboration is crucial to prevent companies from relocating to areas with weaker environmental standards. As the window to limit global warming to 2 degrees Celsius rapidly closes, expanding renewable energy sources and implementing appropriate carbon pricing become increasingly urgent. In the meantime, targeted taxation could be a crucial step toward managing the rising emissions from these high-energy technologies.